Blog posts on economic dataPosts selected fromManagement Blog - Engineering Blog - Investing Blog and other blogs - Global Manufacturing Data by Country from 2001 to 2004

This data shows the United States manufacturing economy is continuing to grow and is solidly the largest manufacturing economy: which contradicts what many believe. It is true manufacturing jobs are decreasing in the United States and worldwide – China is losing far more manufacturing jobs than the USA. continue reading: Global Manufacturing Data by Country from 2001 to 2004 - Manufacturing Jobs Data: USA and China

10-20% of manufacturing jobs disappeared worldwide from 1995 to 2002. China lost between 17% and 34% of theirmanufacturing jobs and the USA lost 11.4% of theirs. continue reading: Manufacturing Jobs Data: USA and China - China’s Manufacturing Economy

The constant mention of the eroding manufacturing sector on the USA I believe leads many to think it is shrinking and small. Yet output continues to increase and the share of worldwide manufacturing output is holding steady. China is gaining substantial ground but the Chinese increase has largely come from Japan and Europe. To me this understanding is important because of my felling about the misperceptions of many. continue reading: China’s Manufacturing Economy - Toyota in the US Economy

From Toyota’s web site: Toyota Manufacturing in the USA: by 2008, Toyota will have the annual capacity to build 1.81 million cars and trucks, 1.44 million engines, and 600,000 automatic transmissions in North America.

The company’s direct employment in North America is more than 38,000 and direct investment is nearly $16.8 billion with annual purchasing of parts, materials, goods and services from North American suppliers totaling an additional $26 billion.

[In 2016 Toyota manufactured 2,450,000 vehicles in the USA, Toyota promotes a fake number for employees counting many non-employees, employees of suppliers etc., so you can't view the accurate data on their site in 2017 - in 2006 they did post an honest number]. continue reading: Toyota in the US Economy - Our Energy Future (2006)

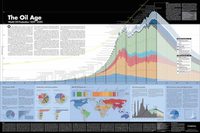

Huge price increases will provide incentives to those in the market to innovate to find alternative ways to make money by providing usable energy sources. If the market, overall, chooses to look forward over a long period of time, then investment in alternatives will begin in earnest early and prices of oil will slowly rise. And as prices rise slowly new alternatives (including ways of reducing consumption) will slowly come into the market. Those alternatives will slowly substitute for oil as a smooth transition is made.

If markets actual were efficient and driven by looking far into the future and discounting cash flows to the present this slow and steady model is what would happen. The market can only be efficient if good long term predictions can be reflected in the market. continue reading: Our Energy Future (2006) - Health Care Crisis (2006)

The USA health care system is broken and has been for a long time. Symptoms like the huge cost of health care, medical errors, ER problems etc. are all related. continue reading: Health Care Crisis (2006) - Gas Tax (2006)

Gross Domestic Product would decline by $6.5 billion per year, in real terms, from 2005 to 2014. In other words, this $131 billion in government revenues would shrink the economy by $65.5 billion.

There would be, on average, 37,000 fewer job opportunities each year. That works out to one lost job for every $351,000 in new taxes, which is equal to 11 years of work at average yearly wages.

Sure sounds bad. This quote was written in 2004 opposing a 5.45 cent increase in the gas tax. Of course gas price have gone up more than 10 times that amount [at the time I wrote this post in 2006]. Those increased prices have the same negative impact of a tax increase but the increased prices paid go to foreign producers and the oil companies instead of the taxpayers. We would have been better off increasing the gas tax 50 cents a gallon and cutting the huge deficit instead of accepting such arguments.

Opposing gas taxes because someone has to pay them, while raising the debt which hurts everyone that will have to fund those debts is not a sensible plan. Voting against pork spending so you don't need to raise gas tax or pass on you unpaid obligations to the future is fine. Or deciding you would rather tax income than gas is another perfectly fine choice. There are good reasons to tax gas but the decision to prefer taxing income to taxing gas use is certainly a fair choice. Saying you are against taxes while increasing spending on the other hand is just dishonest. continue reading: Gas Tax (2006) - The Future for Investors

The subtitle captures the basic theme of the book. Investing in the boring old stocks that people are not excited about is what have performed best.

His basic advise is still to buy the broadest market index fund (such as the Vanguard Total Stock Market Index Fund [the broken link was removed]). He also concludes with the advice that those returns have been beaten historically by focusing on stocks with high dividend yields and low price earnings ratios. continue reading: The Future for Investors - Manufacturing Value Added Economic Data

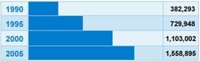

From 1990 to 2001 China's manufacturing is up 250% (it would be even more if 2002 data were available). The United States (as of 2002) is by far the largest manufacturing economy and USA manufacturing continues to grow faster than global manufacturing. continue reading: Manufacturing Value Added Economic Data - Manufacturing Jobs

Focusing on manufacturing output and jobs and their importance to the economy makes sense. However, I think people need to update the model they use to set expectations of manufacturing job levels. And given a world in which no countries seem able to do gain manufacturing jobs, it seems more reasonable to expect a continuation of decreased jobs and increased output until that worldwide trend changes. continue reading: Manufacturing Jobs - Manufacturing in Asia (2007)

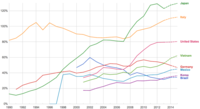

The USA manufacturing share of global output has risen, not fallen, as we have stated numerous times: Manufacturing Value Added Economic Data – Manufacturing Jobs Data: USA and China – Global Manufacturing Data by Country. The most fundamental facts of global manufacturing – Global output is increasing. Jobs are decreasing (everywhere, not moving from one place to another – decreasing everywhere). China’s output is growing rapidly. The USA is still by far the largest manufacturer, USA output is growing faster than global output and much slower than China’s output. continue reading: Manufacturing in Asia (2007) - Top 10 Manufacturing Countries (2007)

...The data also shows a stagnation in USA manufacturing output over the last several years, though the USA remains by far the largest manufacturer. The most significant news from this latest data, I believe, is that that manufacturing output growth in the USA has been slower than global manufacturing output growth from 2002-2005. This was not the case prior to 2002. continue reading: Top 10 Manufacturing Countries (2007) - Data Visualization Example

In Myths About the Developing World, Hans Rosling shows some great graphics to display data on health care outcomes.

The presentation also gives a concrete example of faulty knowledge (people thinking things which are not so - related to theory of knowledg). See gapminder.org for good additional material. continue reading: Data Visualization Example - The Benefits and Risks of Countries Taking on Government Debt

- Historical Global Economic Data and Current Issues for Globalization

China and India/Pakistan accounted for 73% of the world manufacturing output in 1750. They continued to account for over half of global output even as later as 1830. By 1913, however, their share had dropped to 7.5%.

That shows how quickly things changed. The industrialization of Europe and the USA was an incredibly powerful global economic force. The rapid economic gains of Japan, Korea, Singapore, China and India in the last 50 years should be understood in the context of the last 200 years not just the last 100 years.

...

I believe he is onto something. I have for years been seeing the strains of “comparative advantage” in our current world economy. That doesn’t mean I am not mainly a fan of freer trade. I am. I don’t think complex trade deals such as TPP are the right move. And I do think more care needs to be taken to consider current economic conditions and factor that into our trade policies.

...

The complexity of the economic consequences of international trade require knowledge, skill, patience and practical thinking to create economic gains going forward. I am worried about the foolish leaders we are electing in many of the rich countries recently. They do not appear to understand complexity or value the importance of expertise, uncertainty and implementation of economic policy. The complexity today requires more understanding, study, learning and care than was required last century but instead we are electing people with less wisdom than ever (and we were not electing incredibly wise people very often in the past). continue reading: Historical Global Economic Data and Current Issues for Globalization

|