Posts selected fromManagement Blog - Engineering Blog - Investing Blog and other blogs - Health Care Crisis (2006)

The USA health care system is broken and has been for a long time. Symptoms like the huge cost of health care, medical errors, ER problems etc. are all related. continue reading: Health Care Crisis (2006) - Is Innovation Needed to Keep Manufacturing in the USA?

There is no ace in the hole. If countries want to keep manufacturing jobs they are going to have to do lots of things right. No country has such an advantage they can expect to rely on their country being more innovative (or offering cheaper labor, or their citizens working harder or…) than all the other countries in the world.

Innovation has been an advatage for the USA. It should continue to be an advantage for the USA but many other countries will innovate very well (Japan, Germany, China, Korea, Singapore, England…). The USA has many assets: transportation infrastructure, banking, rule of law, educated and skilled workforce, huge market, decent tax laws, engineering education… The key will be to keep focusing on the whole system (and fix things like huge budget deficient, huge current account deficit, excessive health care costs, excessive executive pay…).

I also believe a key competitive advantage will be in applying management improvement concepts such as lean manufacturing. continue reading: Is Innovation Needed to Keep Manufacturing in the USA? - American Manufacturing Successes

- New Look American Manufacturing

Many factors determine whether the USA will continue to lead the world in manufacturing. The USA has to continue to support a dynamic economic system, maintain a transportation system, improve the health care system, improve the educational system, maintain the rule of law, reduce excessive legal costs, improve the management of manufacturers etc.. Each country has to work on these and other systems to stay competitive globally.

...

Excessive regulation compared to what countries – China, India, Germany, Japan? If you are talking about environmental regulation, the USA has more than China less than Germany or Japan. If you are talking about permits to get things done I think the National Association of Manufacturers (NAM) needs to go try to do business in Japan, China, India, Thailand, Mexico… and see how easy it is to navigate the undocumented processes.

And does NAM think the USA is good at nothing? Don’t manufacturers here benefit from being the USA? What cost advantages does that give them? I think being a manufacturer in the USA offers huge advantages as well as some challenges. The prospects are good. continue reading: New Look American Manufacturing - Manufacturing Value Added Economic Data

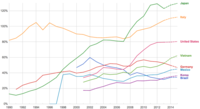

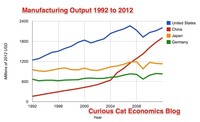

From 1990 to 2001 China's manufacturing is up 250% (it would be even more if 2002 data were available). The United States (as of 2002) is by far the largest manufacturing economy and USA manufacturing continues to grow faster than global manufacturing. continue reading: Manufacturing Value Added Economic Data - Manufacturing Jobs

Focusing on manufacturing output and jobs and their importance to the economy makes sense. However, I think people need to update the model they use to set expectations of manufacturing job levels. And given a world in which no countries seem able to do gain manufacturing jobs, it seems more reasonable to expect a continuation of decreased jobs and increased output until that worldwide trend changes. continue reading: Manufacturing Jobs - The Benefits and Risks of Countries Taking on Government Debt

- Historical Global Economic Data and Current Issues for Globalization

China and India/Pakistan accounted for 73% of the world manufacturing output in 1750. They continued to account for over half of global output even as later as 1830. By 1913, however, their share had dropped to 7.5%.

That shows how quickly things changed. The industrialization of Europe and the USA was an incredibly powerful global economic force. The rapid economic gains of Japan, Korea, Singapore, China and India in the last 50 years should be understood in the context of the last 200 years not just the last 100 years.

...

I believe he is onto something. I have for years been seeing the strains of “comparative advantage” in our current world economy. That doesn’t mean I am not mainly a fan of freer trade. I am. I don’t think complex trade deals such as TPP are the right move. And I do think more care needs to be taken to consider current economic conditions and factor that into our trade policies.

...

The complexity of the economic consequences of international trade require knowledge, skill, patience and practical thinking to create economic gains going forward. I am worried about the foolish leaders we are electing in many of the rich countries recently. They do not appear to understand complexity or value the importance of expertise, uncertainty and implementation of economic policy. The complexity today requires more understanding, study, learning and care than was required last century but instead we are electing people with less wisdom than ever (and we were not electing incredibly wise people very often in the past). continue reading: Historical Global Economic Data and Current Issues for Globalization - USA Household Debt Jumps to Record $13.15 Trillion

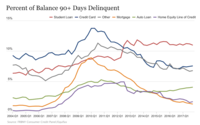

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit, which reported that total household debt increased by $193 billion (1.5%) to $13.15 trillion in the fourth quarter of 2017. This report marks the fifth consecutive year of positive annual household debt growth. There were increases in mortgage, student, auto, and credit card debt (increasing by 1.6%, 1.5%, 0.7% and 3.2% respectively) and another modest decline in home equity line of credit (HELOC) balances (decreasing by 0.9%).

Outstanding consumer debt balances by type: $8.88 trillion (mortgage), $1.38 trillion (student loans), $1.22 trillion (auto), $834 billion (credit card), $444 (HELOC). continue reading: USA Household Debt Jumps to Record $13.15 Trillion - Factfulness – An Extremely Valuable Book

Data is extremely valuable in helping us make decisions and evaluating the effectiveness of policy. However it is critical to be careful. It is very easy to focus on meeting targets that seem sensible – increasing the number of hospital beds – but that lead to less effective policy.

...

The book relentlessly points out the great progress that has been made globally over the last 50 years and how that progress continues today and looks to be set to continue in the future. We have plenty of areas to work on improving but we should be aware of how much progress we have been making. As he points out frequently he has continually seen huge underestimation of the economic conditions in the world today. This book does a great job of presenting the real success we have achieved and the progress we can look forward to in the future. continue reading: Factfulness – An Extremely Valuable Book - An Inverted Yield Curve Predicts Recessions in the USA

The chart shows the 10 year yield minus the 2 year yield. So when the value falls below 0 that means the 2 year yield is higher. Each time that happened, since 1988, a recession has followed (the grey shaded areas in the chart).

Do note that there were very small inversions in 1998 and 2006 that did not result in a recession in the near term. Also note that in every case the yield curve was no longer inverted by the time a recession actually started.

... continue reading: An Inverted Yield Curve Predicts Recessions in the USA - Retirement Portfolio Allocation for 2020

The markets continue to provide difficult options to investors. In the typical market conditions of the last 50 years I think a sensible portfolio allocation was not that challenging to pick. I would choose a bit more in stocks than bonds than the commonly accepted strategy. And I would choose to put a bit more overseas and in real estate.

But if that wasn’t done and even something like 60% stocks and 40% bonds were chosen it would seem reasonable (or 60% stocks 25% bonds and 15% money market – I really prefer a substantial cushion in cash in retirement). Retirement planning is fairly complex and many adjustments are wise for an individual’s particular situation (so keep in mind this post is meant to discuss general conditions today and not suggest what is right for any specific person).

This post was written before #covid19 became the enormous economic clamity it has become. Based on the poor preparation to fight Covid19 by the USA and Europe I sold some stocks and reduced global exposure and emeriging market exposure. I didn't reduce it to zero or anything close to that, but as I say I am usually overweight stocks and I had reduced how much I was overweight due to high stock valuations and with the likely Covid 19 problems I further reduced stocks to make my portfolio probably even a little bit underweight stocks (but still over 50% stocks).

I am more active than most people should be with their investments (I think it works for me but maybe I should be less active too, I just pay much more attention than most people and feel I can make some adjustments that are sensible.). continue reading: Retirement Portfolio Allocation for 2020 - Huge Growth in USA Corporate Debt from 2005 to 2020

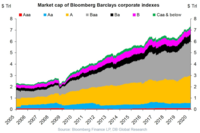

There are many problems with the extremely low interest rates available in decade since the too-big-to-fail financial crisis. The interest rates seem to me to be artificially sustained by massive central bank actions for 12 years now.

Extraordinarily low rates encourage businesses to borrow money, after all how hard is it to invest in something that will return the business more than a few percent a year (that they can borrow at). Along with the continued efforts by the central banks to flood the economy with money any time there is even a slowdown in growth teaches companies to not worry about building a business that can survive bad times. Just borrow and if necessary borrow more if you are having trouble then just borrow more. continue reading: Huge Growth in USA Corporate Debt from 2005 to 2020 - The Growing Use of Apprenticeships in the USA

- Manufacturing Outlook and History In the USA and Globally

The USA manufacturing base is growing and far from crumbling (job losses are deceiving as they are global and not an indication of a USA manufacturing decline). China’s manufacturing growth is incredible. China and the USA are far away the top 2 manufacturing countries. continue reading: Manufacturing Outlook and History In the USA and Globally

|